|

|

| 第65行: |

第65行: |

| | align="right" valign="top" |'''文字版备查'''|| ||<small>(a) State what is meant by ‘a recession’. [3]</small> | | | align="right" valign="top" |'''文字版备查'''|| ||<small>(a) State what is meant by ‘a recession’. [3]</small> |

| |} | | |} |

| | <br/> |

| | <br/> |

| | <br/> |

| <br/> | | <br/> |

| {| | | {| |

| 第82行: |

第85行: |

| | align="right" valign="top" |'''文字版备查'''|| ||<small>(b) Analyse why governments borrow and why it is said that a government should increase spending in a recession. [5]</small> | | | align="right" valign="top" |'''文字版备查'''|| ||<small>(b) Analyse why governments borrow and why it is said that a government should increase spending in a recession. [5]</small> |

| |} | | |} |

| | <br/> |

| | <br/> |

| | <br/> |

| <br/> | | <br/> |

| {| | | {| |

| 第99行: |

第105行: |

| | align="right" valign="top" |'''文字版备查'''|| ||<small>(c) Consider what is meant by the phrase ‘government borrowing could ‘crowd out’ the private sector.’ [6]</small> | | | align="right" valign="top" |'''文字版备查'''|| ||<small>(c) Consider what is meant by the phrase ‘government borrowing could ‘crowd out’ the private sector.’ [6]</small> |

| |} | | |} |

| | <br/> |

| | <br/> |

| | <br/> |

| <br/> | | <br/> |

| {| | | {| |

| 第117行: |

第126行: |

| |} | | |} |

| <br/> | | <br/> |

| | |

| | ==Essay - Micro微观== |

| {| | | {| |

| |- | | |- |

| 第133行: |

第144行: |

| | align="right" valign="top" |'''文字版备查'''|| ||<small>2 The use of air travel leads to market failure caused by negative externalities. With the help of a diagram, assess the extent to which a government can intervene to correct this market failure. [20]</small> | | | align="right" valign="top" |'''文字版备查'''|| ||<small>2 The use of air travel leads to market failure caused by negative externalities. With the help of a diagram, assess the extent to which a government can intervene to correct this market failure. [20]</small> |

| |} | | |} |

| | <br/> |

| | <br/> |

| | <br/> |

| <br/> | | <br/> |

| {| | | {| |

| 第151行: |

第165行: |

| |} | | |} |

| <br/> | | <br/> |

| | |

| | ==Essay - Macro宏观== |

| {| | | {| |

| |- | | |- |

| 第167行: |

第183行: |

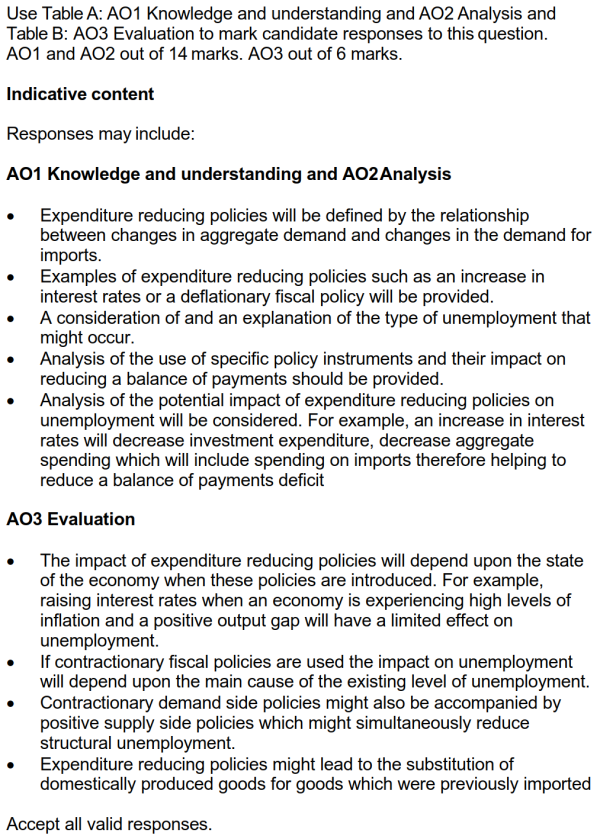

| | align="right" valign="top" |'''文字版备查'''|| ||<small>4 Expenditure-reducing policies will reduce a balance of payments deficit but will also cause significant unemployment. Evaluate this statement. [20]</small> | | | align="right" valign="top" |'''文字版备查'''|| ||<small>4 Expenditure-reducing policies will reduce a balance of payments deficit but will also cause significant unemployment. Evaluate this statement. [20]</small> |

| |} | | |} |

| | <br/> |

| | <br/> |

| | <br/> |

| <br/> | | <br/> |

| {| | | {| |

2023年6月10日 (六) 14:01的最新版本

【点此返回历年真题目录】

单题搜索方法:右上角搜索中输入该题中的部分文字,点击搜索后进入相关页面,然后使用ctrl+F5(或其他按键组合调出搜索框),再次搜索该题干文字,直接定位到题目。

整卷下载

关于难度分类的说明:

容易 :概念类、识别类、公式计算类

中等 :原因分析类、影响分析类、图像分析类、计算分析类

困难 :全新概念类、全新场景类、全新图像类、推导复杂类、观点评价类、对比评价类、政策评价类

Data response

中英对照

| 原文 |

参考译文(谷歌机翻)

|

Increasing public sector debt is a good policy

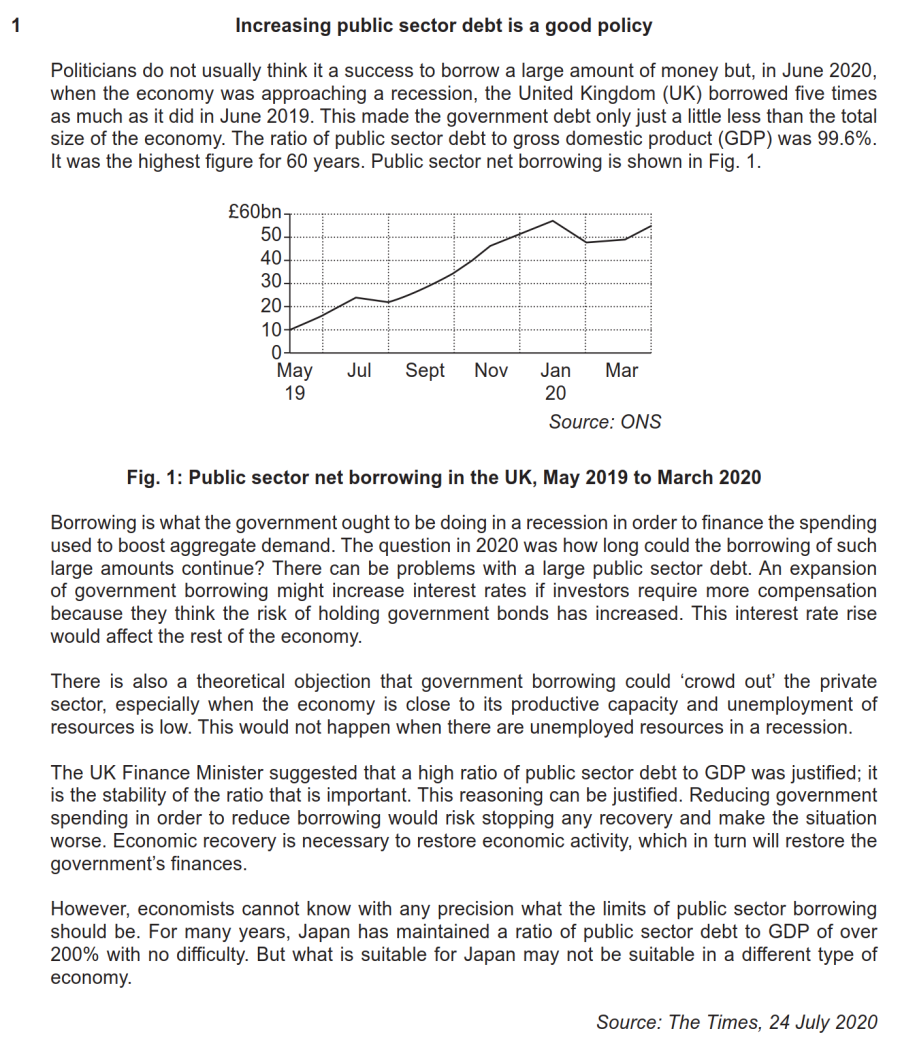

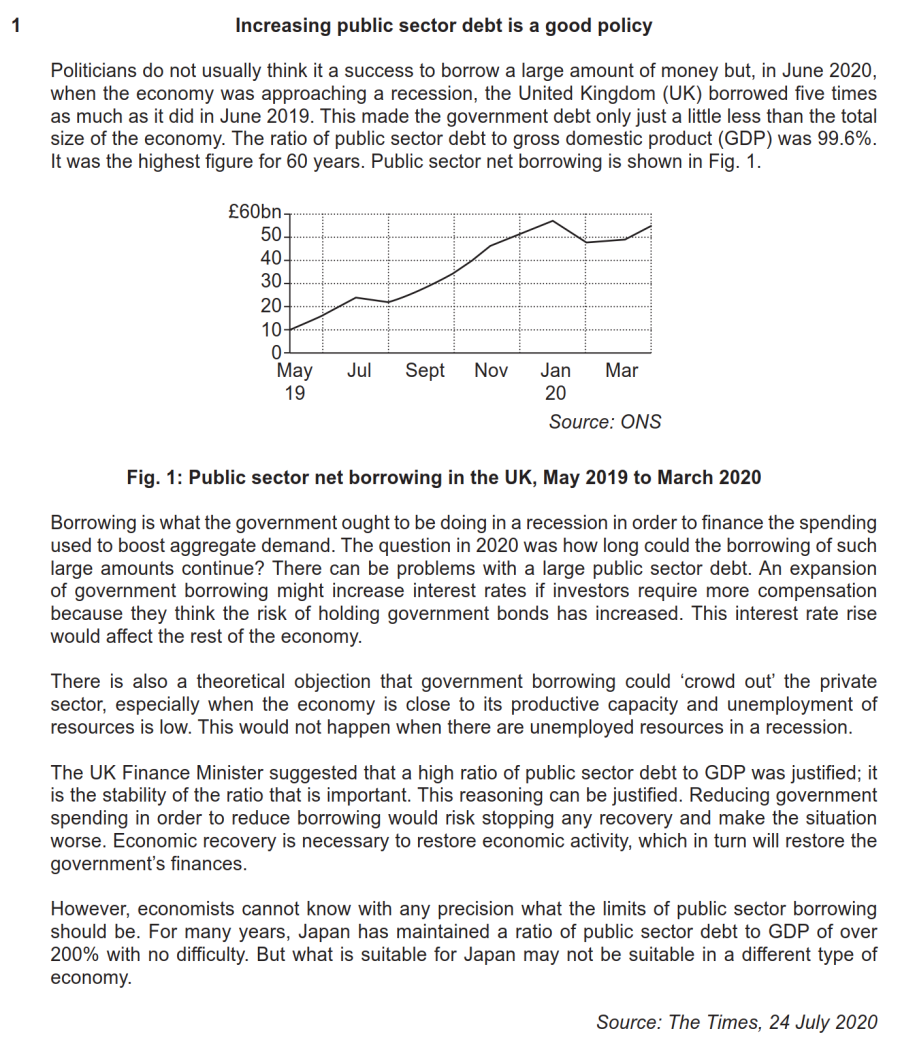

Politicians do not usually think it a success to borrow a large amount of money but, in June 2020, when the economy was approaching a recession, the United Kingdom (UK) borrowed five times as much as it did in June 2019. This made the government debt only just a little less than the total size of the economy. The ratio of public sector debt to gross domestic product (GDP) was 99.6%. It was the highest figure for 60 years. Public sector net borrowing is shown in Fig. 1.

Borrowing is what the government ought to be doing in a recession in order to finance the spending used to boost aggregate demand. The question in 2020 was how long could the borrowing of such large amounts continue? There can be problems with a large public sector debt. An expansion of government borrowing might increase interest rates if investors require more compensation because they think the risk of holding government bonds has increased. This interest rate rise would affect the rest of the economy.

There is also a theoretical objection that government borrowing could ‘crowd out’ the private sector, especially when the economy is close to its productive capacity and unemployment of resources is low. This would not happen when there are unemployed resources in a recession.

The UK Finance Minister suggested that a high ratio of public sector debt to GDP was justified; it is the stability of the ratio that is important. This reasoning can be justified. Reducing government spending in order to reduce borrowing would risk stopping any recovery and make the situation worse. Economic recovery is necessary to restore economic activity, which in turn will restore the government’s finances.

However, economists cannot know with any precision what the limits of public sector borrowing should be. For many years, Japan has maintained a ratio of public sector debt to GDP of over 200% with no difficulty. But what is suitable for Japan may not be suitable in a different type of economy.

|

增加公共部门债务是一项好政策

政客们通常认为借入大量资金并不成功,但在2020年6月,当经济接近衰退时,英国(UK)的借贷量是2019年6月的五倍。这使得政府债务仅略低于经济总量。公共部门债务与国内生产总值(GDP)的比率为99.6%。这是60年来的最高数字。公共部门净借款如图1所示。

借贷是政府在经济衰退时应该做的事情,以便为用于提振总需求的支出提供资金。2020年的问题是,如此巨额的借贷还能持续多久?公共部门的巨额债务可能会出现问题。如果投资者因为认为持有政府债券的风险增加而需要更多补偿,那么扩大政府借贷可能会提高利率。利率上升将影响经济的其他部分。

还有一个理论上的反对意见,即政府借贷可能会“挤出”私营部门,尤其是当经济接近其生产能力且资源失业率较低时。当经济衰退中有失业资源时,这种情况就不会发生。

英国财政部长表示,公共部门债务占GDP的高比例是合理的;重要的是比率的稳定性。这个推理是有道理的。减少政府支出以减少借贷可能会阻止任何复苏并使情况变得更糟。经济复苏是恢复经济活动所必需的,而经济活动又将恢复政府的财政状况。

然而,经济学家无法准确知道公共部门借款的限度应该是多少。多年来,日本一直轻而易举地将公共部门债务占GDP的比例保持在200%以上。但适合日本的东西不一定适合不同类型的经济体。

|

| 题目1a |

|

|

| 题目类型 |

|

概念识别

|

| 难度 |

|

容易

|

| 考察知识点 |

|

recession的概念

|

| 解答要点 |

|

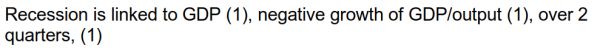

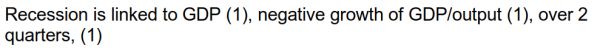

● 写出recession的概念,注意强调GDP连续两个季度以上负增长。

|

| 官方答案 |

|

|

| 文字版备查 |

|

(a) State what is meant by ‘a recession’. [3]

|

| 题目1b |

|

|

| 题目类型 |

|

文字分析

|

| 难度 |

|

中等

|

| 考察知识点 |

|

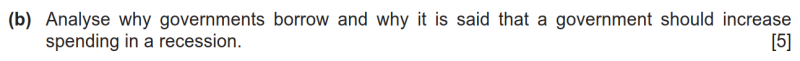

government borrowing的原因;expansionary fiscal policy的作用

|

| 解答要点 |

|

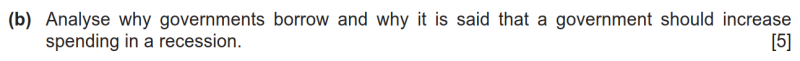

● 本题由两个问题组成,需要依次进行解答。

● 政府借贷的原因主要是为了补充财政赤字,如果支出大于税收收入,则需要借贷。

● 政府借贷后能够为政府支出提供更多资金,从而促进经济增长,增加就业,提高人们的收入和生活质量等。

|

| 官方答案 |

|

|

| 文字版备查 |

|

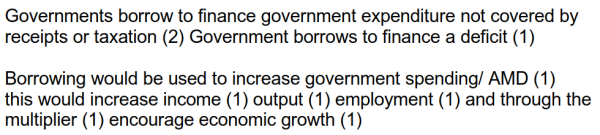

(b) Analyse why governments borrow and why it is said that a government should increase spending in a recession. [5]

|

| 题目1c |

|

|

| 题目类型 |

|

文字分析

|

| 难度 |

|

困难

|

| 考察知识点 |

|

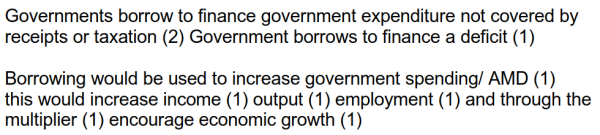

crowding out的含义和影响

|

| 解答要点 |

|

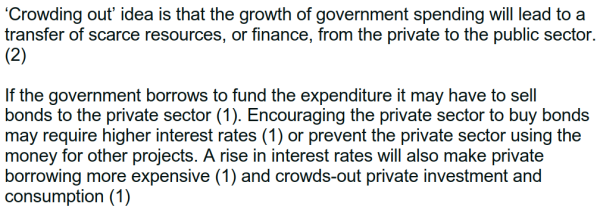

● 先写crowding out的定义,即政府支出会导致资源从私企流向国企(私企被排挤出市场)。

● 然后讨论产生这种情况的逻辑链。政府借贷会导致对货币需求上升,利率上升,私企借贷困难,投资减少。

|

| 官方答案 |

|

|

| 文字版备查 |

|

(c) Consider what is meant by the phrase ‘government borrowing could ‘crowd out’ the private sector.’ [6]

|

| 题目1d |

|

|

| 题目类型 |

|

观点讨论

|

| 难度 |

|

困难

|

| 考察知识点 |

|

government borrowing的影响

|

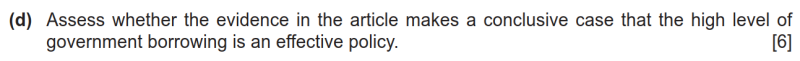

| 解答要点 |

|

● 本题需要分成借贷有好处和有问题两个角度进行分析。

● 好处包括没有crowding out、减少budget deficit。

● 问题包括债务水平为近60年最高、提高利率减少投资等。

● 最后给出结论,文中证据没有太多说服力inconclusive。

|

| 官方答案 |

|

|

| 文字版备查 |

|

(d) Assess whether the evidence in the article makes a conclusive case that the high level of government borrowing is an effective policy. [6]

|

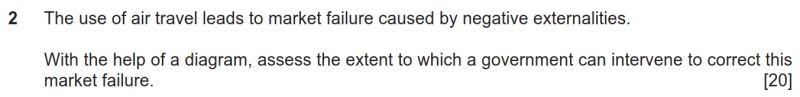

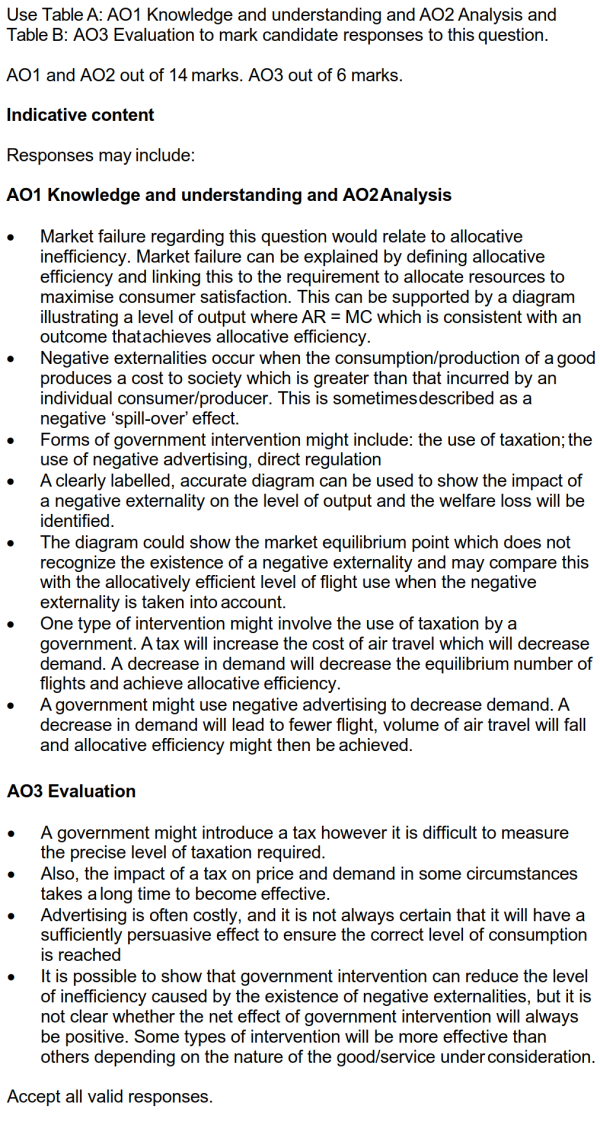

Essay - Micro微观

| 题目2 |

|

|

| 题目类型 |

|

文字分析(含画图)

|

| 难度 |

|

困难

|

| 考察知识点 |

|

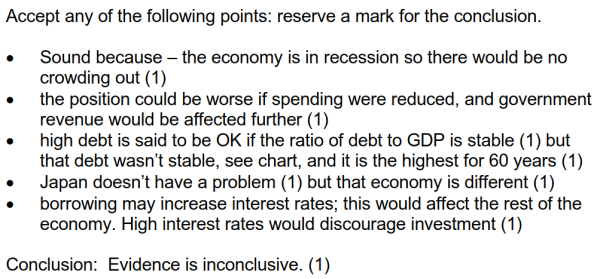

market failure;政府纠正市场失灵的方式

|

| 解答要点 |

|

● 先写market failure、negative externality的定义,画出图像(负生产外部性和负消费外部性都要画一下),分析效率和deadweight loss,说明市场失灵带来的影响,比如over-consumption等。

● 然后考虑各类政府干预政策,比如税收、宣传、法律法规等。至少考虑2个政策,有些可以画图的政策(如税收)需要运用图像来说明。每个政策需要说明如何减少了市场失灵。

● 最后考虑evaluation,指出每个政策的问题,比如税收难以确定准确数量、宣传没有强制性、政府额外支出等。需要点评一下这些政策是否有必要进行,或者指出哪个政策最适合使用(比较各类政策的有用性)。

● 注意写总结段。

|

| 官方答案 |

|

|

| 文字版备查 |

|

2 The use of air travel leads to market failure caused by negative externalities. With the help of a diagram, assess the extent to which a government can intervene to correct this market failure. [20]

|

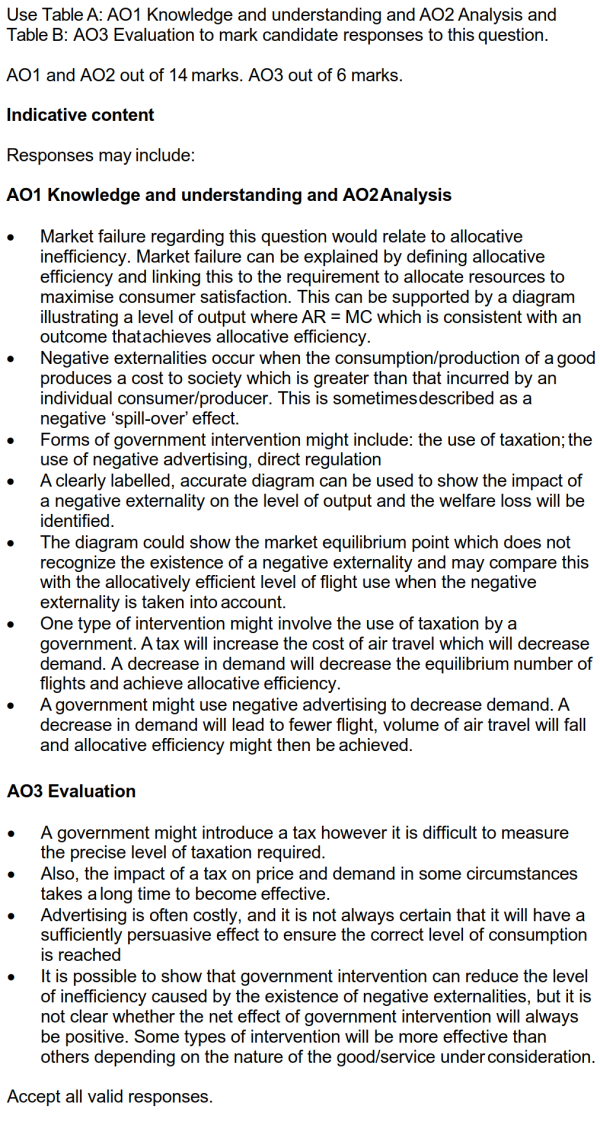

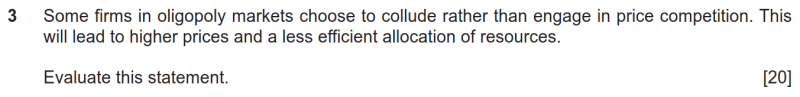

| 题目3 |

|

|

| 题目类型 |

|

观点讨论

|

| 难度 |

|

困难

|

| 考察知识点 |

|

oligopoly的特征;collusion的方式与影响

|

| 解答要点 |

|

● 先说明oligopoly的assumptions(特征)。

● 解释寡头市场中的collusion,可适当使用game theory说明,指出cartel和price leadership并做适当解释。

● 对生产效率和分配效率进行解释,讨论在cartel和price leadership下,价格为何上升,效率为何下降。

● 讨论寡头市场中的竞争情况,说明一些竞争形式,如广告、售后服务、价格战等,解释这些竞争形式对价格和效率的影响,并与collusion对比,说明有些企业为何不选择竞争而选择合作。

● 最后考虑evaluation,说明寡头市场中的collusion有时也能带来一定的好处,比如技术进步和dynamic efficiency、产品选择性增加、企业扩张并享受economies of scale。此外,一些问题能够在政府干预下解决,可列举一些政府干预方式并说明如何减少寡头collusion带来的问题。

● 最后进行总结。

|

| 官方答案 |

|

|

| 文字版备查 |

|

3 Some firms in oligopoly markets choose to collude rather than engage in price competition. This will lead to higher prices and a less efficient allocation of resources. Evaluate this statement. [20]

|

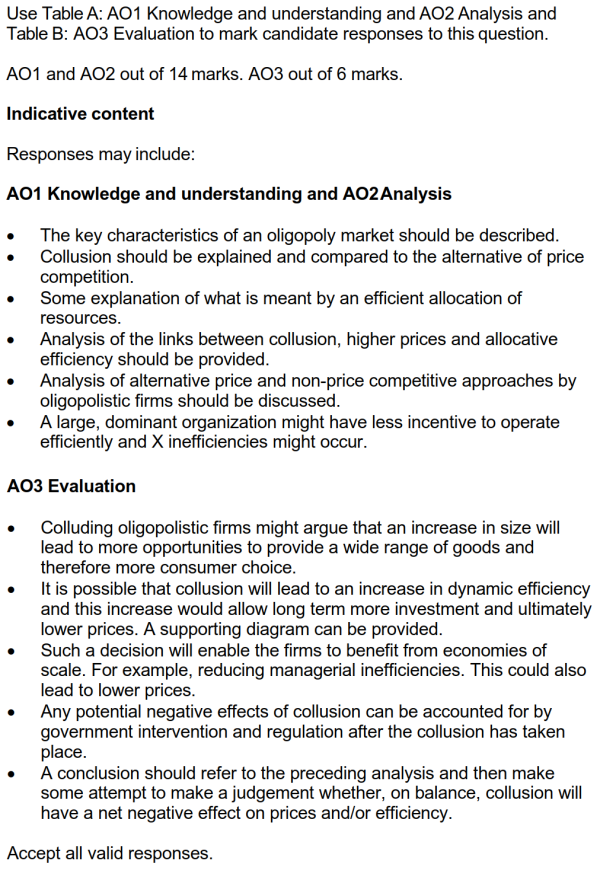

Essay - Macro宏观

| 题目4 |

|

|

| 题目类型 |

|

观点讨论

|

| 难度 |

|

困难

|

| 考察知识点 |

|

expenditure-reducing policy的具体形式及影响

|

| 解答要点 |

|

● 先说明expenditure-reducing policies的定义。

● 解释具体的政策(至少2个),比如增加税收、减少政府支出、增加利率等,说明其如何降低AD,并解释其与减少current account deficit之间的关系。

● 再解释这些政策如何带来了更多的失业。失业需要进行类型的分析,指出cyclical unemployment会增加。

● 最后进行evaluation,比如如果还有supply-side policy则失业可能不会增加太多、部分失业类型和上述政策关系不大(比如frictional失业)、和经济所在阶段有关(经济过热时可以顺便纠正该状态)等。

● 注意结尾有总结段。

|

| 官方答案 |

|

|

| 文字版备查 |

|

4 Expenditure-reducing policies will reduce a balance of payments deficit but will also cause significant unemployment. Evaluate this statement. [20]

|

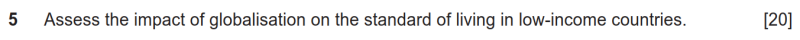

| 题目5 |

|

|

| 题目类型 |

|

文字分析

|

| 难度 |

|

困难

|

| 考察知识点 |

|

globalisation的影响

|

| 解答要点 |

|

● 先说明globalisation的概念和特征、living standard包含的内容以及low-income countries的特征。

● 说明全球化如何改善了低收入国家的生活质量,比如增加产品种类、提升出口促进经济增长、技术和管理经验的引入、高关税收入以带来更多政府支出(改善教育、基建等)等。

● 最后进行evaluation,考虑全球化对低收入国家造成的不良影响,比如剥削工人、环境污染、terms of trade恶化、利润回流本国、突然撤资等。可考虑讨论全球化带来的好处多还是问题多。

● 注意结尾有总结段。

|

| 官方答案 |

|

|

| 文字版备查 |

|

5 Assess the impact of globalisation on the standard of living in low-income countries. [20]

|